UK domestic solar pv installers are looking for new products to sell and solar batteries are likely to be a key part of their sales drive.

Many installers are struggling with big reductions in demand for solar pv installations as the February 2016 cut in Feed In Tariff payments for new installations starts to bite. Selling solar batteries to owners of already installed solar pv systems makes total sense – for solar installers – as they seek to reinvent themselves. But despite what many sales people may tell you in coming months and years, the time for battery storage for most of us has not yet come. Not in 2016 or probably even 2017 or 2018.

Solar battery storage is an unattractive investment for most

I say most of us because if you are already living off-grid with no connection to the national grid then lower cost storage is great. But those of us on the grid are best to wait some years before taking the solar battery plunge. Sales people will try and bamboozle us (a nicer word than mislead or lie to us) with claims that you will maybe save 20% or 30% on your annual electricity bill.

The thought of storing your own solar energy generated during the day for use use at night does feel very appealing but beneath the hype the reality is that you will never recover your original investment. In the next five years the equation could well tip to make the investment financially attractive but not this year.

Let’s be clear. Whilst it is not an investment today for the average homeowner, the development of low cost battery storage will be a game changer for the world. It could blow up the existing business model of the energy giants and the oil producing nations. It will have a huge impact on the growth of electric cars as well as how our energy is generated. So we are big fans for the future potential of this technology.

Tesla Powerwall: Background

The Tesla Powerwall, an US solar battery product with an exciting specification, will come on stream in the next 12-months. It could well be used by the solar industry as the flagship solar battery product so we feel it’s worth explaining what the Tesla Powerwall as well as other competitor products are likely to offer to domestic customers.

Firstly the Tesla Powerwall has a great brand image. Linked to fast electric sports cars and the activities of Elon Musk, the billionaire CEO of Tesla and SpaceX, the brand works well with consumers. It’s clear that Musk is betting on innovative technology for the long term. Tesla are building a state of the art high volume battery production facility in Nevada. In Tesla’s words this “Gigafactory will produce batteries for significantly less cost using economies of scale, innovative manufacturing, reduction of waste, and the simple optimization of locating most manufacturing process under one roof“. It’s a big step forward for electric cars and as a spin off solar battery development will reap benefits. However even in 2020 when the plant is at full capacity it will be a big stretch to make solar batteries an attractive investment for us.

Tesla Powerwall: Ambitious Performance Targets

The Tesla Powerwall will have 6.4kWh of storage and be guaranteed for 10 years. The 10-year warranty is a bit of an unknown as we haven’t seen test figures for degradation in battery output over this length of time. Lithium-ion batteries generally lose some performance over time and depending on the number of charge cycles. Whether that degradation is 1%, 2% or more per year would be a guess at this stage. From what Tesla have described, they have built in a little bit of extra capacity so that the 6.4kWh can be maintained over 10 years so we will give them the benefit of the doubt here and assume no battery degradation.

A Little Basic Maths

To evaluate the benefit of battery storage we can do some simple sums to work out the savings each kiloWatt hour (kWh) of storage can give us. I say simple but I have met sales people who doubt this basic calculation as it doesn’t support their exaggerated claims.

Anyway. let’s assume that we can generate enough electricity every day of the year and store it in our one kWh battery for use later when the sun sets. What is that worth to us? Well the variable cost of a kWh of electricity bought from an energy supplier is currently around 12-13p. We also pay a daily standing charge that will probably bump up the total cost to around 15p. Since we can’t avoid the standing charge we will use the 13p cost for our purposes.

Our total benefit if this one kWh lithium-ion battery performed with no battery degradation over 10 years is

365 days x 1kwh x £0.13 x 10 years = £474.50 per kWh

So on this basic maths, we certainly wouldn’t get an investment return on a product that cost us more than £474.50 per kWh of battery storage to fully install. As we will see later, with our typical 4kW domestic system in the UK we actually can’t fill a 6.4kWh Tesla Powerwall every day of the year so we actually need a price well below this figure.

Why won’t sales people like this basic maths?

Sales people currently don’t have a product to sell that costs less than £474.50 per kWh of battery storage (that’s fully installed cost remember, not just the cost of a battery pack). So they will try and argue that there is also a risk of energy prices soaring over the next 10 years and that consequently the 13p per kWh in year 10 could be much much higher. They will probably quote a government forecast (DECC – Department for Energy and Climate Change) that wholesale electricity prices could be 50% higher or more in 20-years time.

Now nobody knows what the market price of oil and gas will be tomorrow let alone in 10 or 20 years time. To prove the point, around the same time DECC made this long term forecast of electricity prices, DECC’s annual energy assessment assumed that the oil price in 2016 would be around $92/barrel. Of course they didn’t just pick one number but forecast that oil would be in a range from $88-$125/barrel. Brent crude oil is currently hovering around $40/barrel. Quite a big forecasting miss. I’m glad I didn’t snap up oil futures at $88/barrel.

Why would you put faith in DECC’s ability to forecast prices in 10 years time when they are so far out on a forecast a year later? I don’t want to be too hard on DECC. They are paid to plan for different scenarios and if anyone could predict the price of oil accurately they would be making a fortune on the financial markets, not forecasting for the government. Beware of salesman using flawed DECC forecasts to support their sales argument.

Now it really doesn’t matter what so called experts are forecasting the energy price to be in 10 years time. You don’t have to make that investment decision today. Deferring the decision until current electricity prices give you a good return is the best approach. That’s not what sales people will tell you but they have a product to sell today. When sales people show you their assumptions for how high electricity prices could be in two years then take a quick look at the two year fixed electricity supply deals that are currently available on the market. In spring 2016 you could easily get 2 year deals for around 12-13p per kWh. Another thing to consider is that battery storage costs will come down every year; historically they have fallen by around 8% per year. With the big investments in things like the Tesla “Gigafactory” this is likely to continue and accelerate.

The maths gets a bit more complicated

Most of us with domestic solar pv systems could store one kWh in a battery on most days of the year. However in winter months and with larger sizes of battery storage it gets a bit more of a challenge.

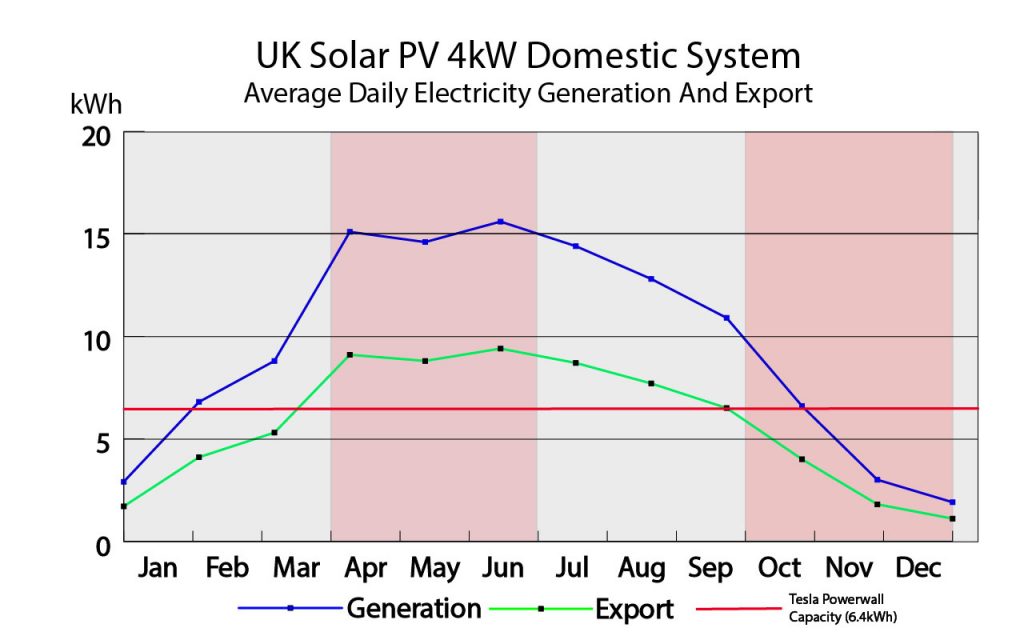

Here we have typical average daily electricity generation for a 4kW solar system, generating around 3,400kWh per year. We have assumed that we are exporting a generous 60% of our power and using 40%. Actually in the winter months self-consumption will be higher but we want to look at an optimistic situation here.

The red line marks the published battery storage capacity of the Tesla Powerwall which is 6.4kWh. In the April-September period we will on most days have enough excess solar generated electricity to fully charge the Tesla Powerwall batteries with electricity we would otherwise have exported. However there will be some overcast days where we can’t quite generate enough and can only store 4 or 5kWh in a day. During October-March the picture is not so good. Based on variations in daily output on a typical system, the maths say that overall we have enough spare electricity to store no more than 1,635kWh of our currently exported 2,040kWh per year in the Tesla Powerwall. This means we get to store about 256kWh per year per kWh of Tesla battery storage or 70.0% of the theoretical 365kWh capacity. Put another way 0.7kWh per day per kWh of storage. So without battery degradation we can work out the 10 year saving as

365 days x 0.7kWh x £0.13 x 10 years = £332.15 per kWh of battery storage

I would pay no more than £1,920 for a fully installed 6.4kWh Tesla Powerwall

Speaking personally, I will start to get interested when I can buy a fully installed battery system with a 10 year warranty at somewhere close to £300 per kWh of battery storage. That would give me around a £200 return on my £1,920 investment (£300 x 6.4kWh is how I worked out the £1,920 price) after 10 years. With any luck the batteries will go on longer than 10 years. Not an amazing investment but after 10 years the price of replacement batteries will have fallen again so I will get an even better return next time round. Especially as I shouldn’t have to pay the full installation cost; just the cost to upgrade the failed batteries. I do love the idea of using energy my solar system has generated but not if it costs me more money than buying from the grid.

Whilst I would pay £1,920 for my 6.4kWh system I don’t expect anyone to want to sell it to me as they would sell at a big loss. Pricing of the Tesla Powerwall is pretty sketchy. Green Mountain Power of Vermont, USA, are offering a system for £4,600 ($6,500) which equates to £718 per kWh of storage capacity or well over double what I am willing to pay per kWh. No doubt prices will come down in the next few years but I will be keeping my cash until we hit the £1,920 price point or there is a big move up in electricity prices which changes the equation.

There are a number of 2kWh battery storage systems on the market and using my £300/kWh rule means I would pay no more than £600 for an installed system like this. We have the 2kWh Powervault at around £2,500 installed price (£1,250 per kWh) and the 2kWh Maslow smart energy storage at a similar price. We have some way to go before these become a serious investment prospect.

Part of the attraction in Vermont is protection against power outages which are much more frequent and typically last 2 hours. So it is the cost of loss of power, combined with the saving on energy, that makes this attractive to some customers in the USA. Also some US customer operate off grid system.

Most UK systems are not off grid

Most of us in the UK do not have a solar system configured for off-grid operation, so if the grid power fails then we will lose power even with the sun shining. With battery storage a domestic solar system would need to be far bigger than 4kW to provide power to see you through a 24 hour period in November-January when solar generation is low. Whilst there is some value in having power during grid outages, today I don’t think it is worth spending more than £500. Things do change; some disaster or incompetence in electricity generation planning in the future could alter this equation. Most of us don’t think of investing in a diesel generator backup but a 5kW diesel generator can be purchased for under £1,000 and could provide power all winter long; not very eco-friendly maybe but diesel generation to cover capacity shortfall is what the government is encouraging power companies to invest in. 5kW is more than enough to power a typical home.

One feature of the 2kWh Maslow system mentioned above is easier access to the DC battery storage. In the event of a power cut, even without an off grid system, it would allow you to power some low voltage DC emergency lighting directly from the battery storage. Additionally there is a 240 volt plug socket which could be used to charge a mobile phone or even plug in a broadband router to access the web via a laptop or tablet. A small step in the right direction. With LED lighting being the most common now you have to ask why a house’s lighting circuit shouldn’t be low voltage DC anyway.

If you have an off-grid system in the UK then the maths changes again.

When should I invest in solar batteries?

The simple answer is that you will probably make a financial return when:

- The price falls below £300 per kWh of installed battery storage. This could well take around 5 years or more.

- The price you pay for electricity soars above 20p per kWh. This does not look likely in the next few years.

- The government offers incentives for installing battery storage. Again this looks unlikely before 2020 as the current government seems committed to nuclear and gas generation of electricity. In Germany this is already available so don’t fall for income comparisons with German homes.

- The government clarifies the impact of installing battery storage on FIT export payments. At the moment the FIT payments assume you export 50% of the electricity generated by your system. You get a payments of 4.85p per kWh assumed exported. With the introduction of Smartmeters by 2020 the amount you actually export will be measured. So if you are storing electricity rather than exporting it your FIT payments will reduce which offsets some of the gains you make on using electricity you generate.

- The electricity industry offers incentives for using your stored energy to smooth supply. This is worth looking at in a little more detail

Incentives for grid smoothing

We all know that the electricity generators face big hikes in demand at times. When 20 million people finish watching a tv programme in the evening and all rush to put the kettle on then demand can spike. Currently this spike is normally covered by hydro generation as it is hard or impossible to instantly switch on additional wind or nuclear generation and most gas and coal plants are designed to run more steadily. However if a few million kWh of solar batteries were available and could put their power on the grid then in theory this could happen instantly. So a battery that was connected to the web could act as part of a national energy storage resource. There are a number of companies who are exploring this and in a decade it will possibly happen big time. Payments for peak or back up power capacity could form an important element of any future decision. One to watch.

Summary of Domestic Battery Storage

The potential for battery storage technology is massive and potentially game changing in the power generation business.

However from an investment return perspective the technology is nowhere near ready for domestic solar use.

Give it three or four years when Tesla have their battery manufacturing plant fully up and running and it will be worth revisiting but in the meantime don’t fall for the bamboozling sales speech of sales people. Try out our new Solar Battery Calculator which works out possible savings on your electricity bill.

Leave a Reply