A key element in the debate about reducing UK carbon emissions from homes is how affordable it would be, for government and consumers, to achieve near zero emissions, in both new homes and in existing housing stock. This article explores options for building new homes, illustrating the issues using an example 3 bedroom detached house of floor area 80m2.

To deliver on its carbon reduction commitments, the UK government already plans to introduce two key measures for new homes from 2025:

- More demanding standards for home insulation, including improved air tightness and use of a Mechanical Ventilation Heat Recovery (MVHR) system.

- A requirement for “low carbon heating”, in the form of a heat pump.

These standards would initially affect some 200,000 new homes built per year, adding an estimated £6,0001 to the build costs for a typical new 3-bedroom home. This would add around £1.2 billion per year to UK house building costs.

Conclusions From Analysis

For new build homes, implementing improved insulation measures and using an Air Source Heap Pump (ASHP) rather than a gas boiler appears to be a pragmatic and sensible approach which should deliver gradually reducing carbon emissions at an affordable cost. Requiring improved insulation and an ASHP will, by 2035, result in reductions in annual greenhouse gas emissions of 89%, with energy bill savings of around £303 per year (23%) when compared with a 3 bedroom house built to existing Building Regulations. Payback on the additional build costs, in terms of energy bill savings, would be around 23 years whilst also delivering a better ventilated house which is less prone to damp or stale air.

Let’s see how that conclusion is reached….

Carbon Emissions & Household Energy Bills In New Build Homes

When setting energy policy, a balance has to be struck between the likely energy cost and the carbon emissions generated by use of a particular form of energy, both now and in the future. The analysis in this article assumes that:

- Electricity grid emissions drop from 233 grams CO2e per kWh in 2019 to 41 grams by 2035

- Carbon taxes are gradually applied to both gas and electricity at the same rate of £100 per tonne of CO2e by 2035, with tax equalised in 2022 between fuels at £40 per tonne of CO2e. This compares with today’s costs of approx £33 per tonne for electricity and £0 per tonne for gas. See the bottom of this article for more detail on carbon taxes.

- Building regulations are amended to require annual space heating energy demand of 15 kWh per m2.

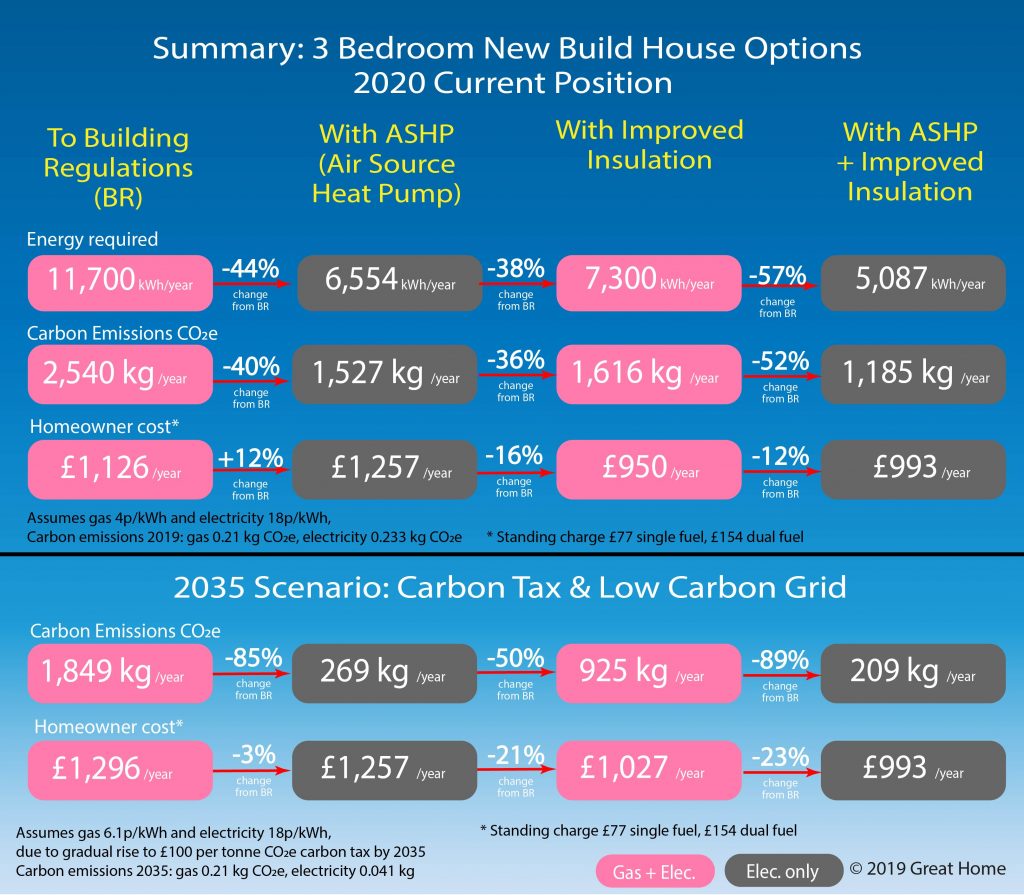

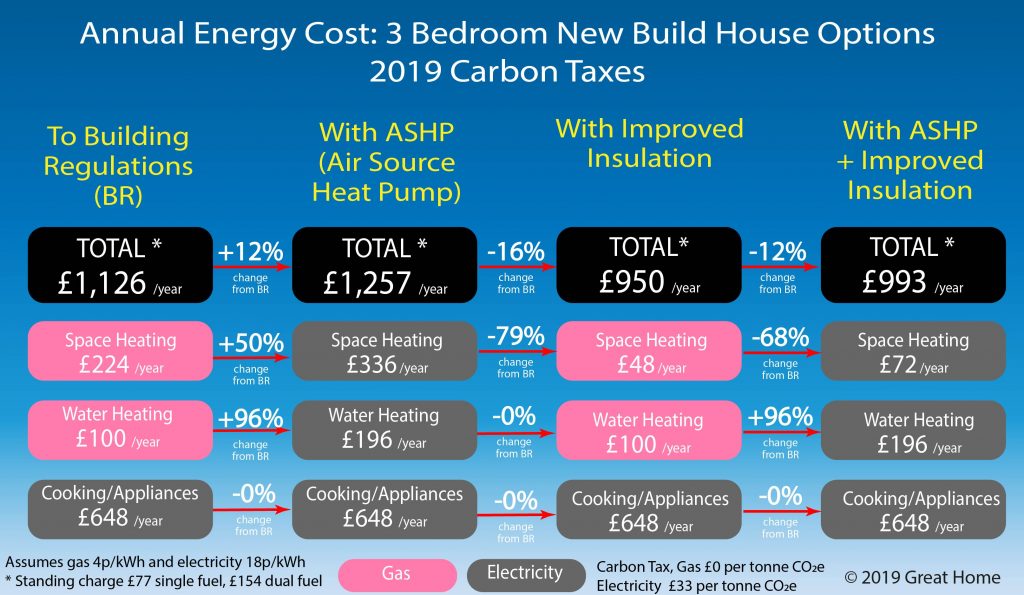

Figure 1 below provides a summary of the impact on a 3-bedroom detached house built in 2019 that uses the proposed insulation and Air Source Heat Pump (ASHP) measures, both individually and together.

Combining the measures could give energy bill savings of 12% (£133) per year in 2020, compared to a home built to current building regulations and with gas heating. As grid emissions drop and carbon taxes are equalised then this saving increases to 23% (£303) per year in 2035. Carbon emissions drop by 52% in 2020 and by 89% by 2035. Implementing only one of the measures results either in more expensive fuel bills or much higher carbon emissions.

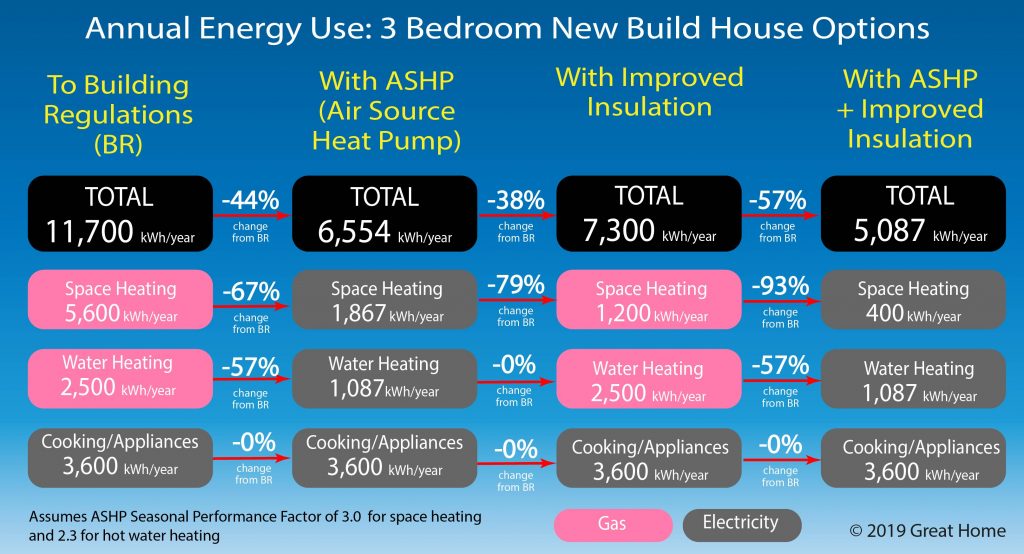

Impact On New Build Home Energy Consumption

Figure 2 gives greater detail by breaking home energy consumption down by type of energy use. Switching to an Air Source Heat Pump (ASHP) reduces energy demand for both space and water heating, whilst improving insulation measures only reduces space heating demand. None of the measures are assumed to reduce the energy consumption from appliances or cooking, although in reality all options could benefit from more efficient cooking methods (induction hobs) and more energy efficient appliances. The big fall in heating energy is because an ASHP can extract additional heat from outside air, meaning that 3 kWh of space heating can be obtained for consumption of 1 kWh of electricity.

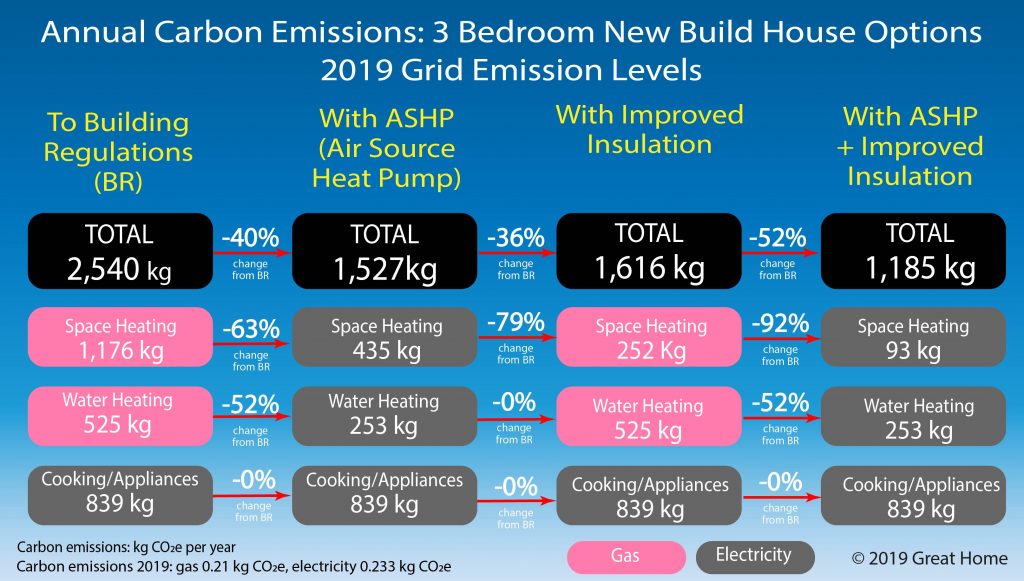

Impact On Carbon Emissions From A New Build Home

Figure 3 shows that the combined measures of improved insulation and ASHP leads to the greatest fall (52%) in carbon emissions using 2019 electricity grid intensity. The use of the ASHP means that emissions from water heating also reduce by 52% compared to the use of gas. These differences get bigger as electricity grid emissions gradually fall in following years, as illustrated in Figure 4 for 2035.

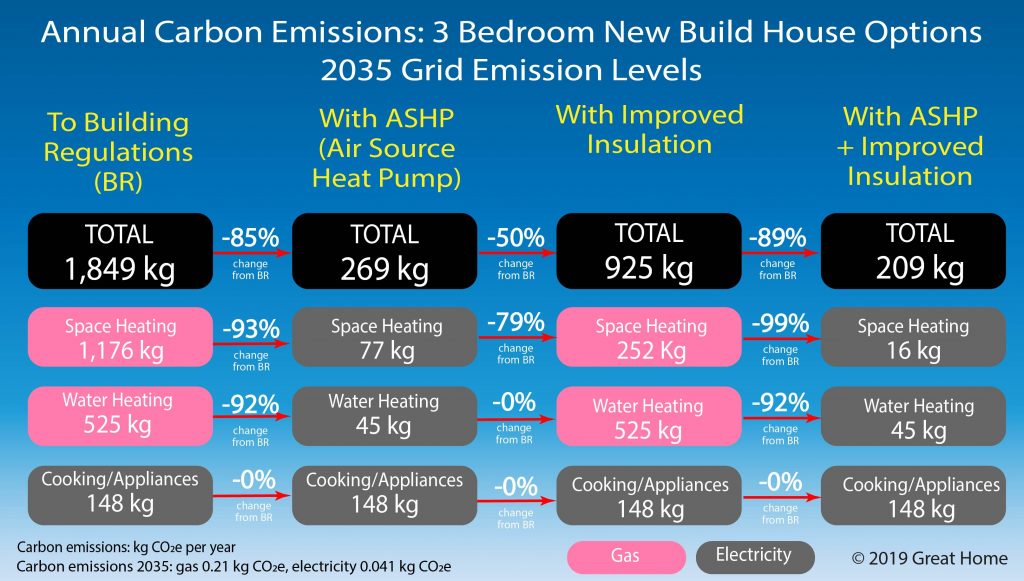

Figure 4 shows that by 2035, switching to the use of decarbonised electricity and away from fossil fuel powered gas boilers results in big falls in emissions from space heating and and water heating. Emissions from cooking/appliances fall across all options. It can be seen that switching to a heat pump creates the opportunity for improvements in grid carbon intensity to feed through immediately, without the homeowner having to take any further action themselves.

Impact On New Build Home Energy Bills

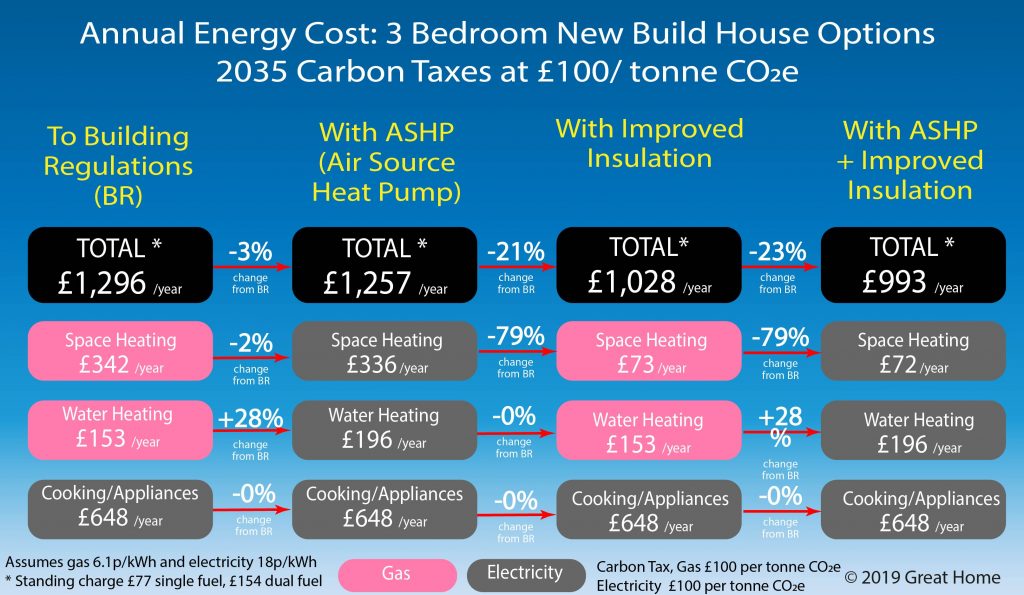

Figure 5 shows the energy cost position in 2019, with a 3 bedroom house with improved insulation and an Air Source Heat Pump (ASHP) being £133/year cheaper to run (£993/year) than a building built to current Building Regulations (£1,126/year). The short term cheapest option is to implement improved insulation, which would reduce 2019 energy costs by £176 compared to current standards. However, as shown in Figures 4-5 above, carbon emissions would be significantly higher than implementing both proposed measures. More importantly, this position changes over coming years, assuming a fair equalisation of “carbon emission taxes” between gas and electricity and by 2035 the combined measures option is cheapest as shown in Figure 6.

Figure 6 shows that the impact of introducing a fair carbon tax across both electricity and gas and increasing it from the current level of £33/tonne CO2e (electricity) and £0/tonne CO2e (gas) to £100/tonne would effectively raise gas prices by 50% to 6.1p per kWh and leave electricity prices unchanged. This would mean that the combined measures approach would result in the cheapest energy bills in 2035, saving £303/year compared to a home built to 2019 Building Regulations. It also shows that implementing an Air Source Heat Pump without improving insulation levels would only save £39 compared to doing nothing.

Summary

For new build homes, implementing the improved insulation measures and using an Air Source Heap Pump (ASHP) rather than a gas boiler will, by 2035, result in a reduction of 89% in annual greenhouse gas emissions for a 3 bedroomed detached house, with energy bill savings of around £303 per year (23%) when compared with a 3 bedroom house built to existing Building Regulations. Payback on the additional build costs, in terms of energy bill savings, would be around 23 years with other benefits being a better ventilated house which is less prone to damp or stale air.

If, in the future, the same measures explored in this article were retrofitted to the existing 29 million UK homes then the cost would be closer to £26,000 per home, although this cost would be lowered depending on the level of insulation already installed and if a heat pump was installed when the gas boiler was due to be replaced. The cost of upgrading existing homes would require somewhere in the £400- £800 billion region spread over a ten-fifteen year period!

Supporting Information

Carbon Taxes In 2019 & 2035

A further factor to consider is that “carbon taxes” are not balanced between electricity and gas use. In 2019, electricity generators have to pay around 0.76 pence per kWh of electricity generated, to cover a UK carbon floor policy (£18 per tonne of CO2e) and EU carbon allowances (circa £14.83 per tonne of CO2e), which are passed on to domestic electricity users. There are no equivalent “carbon taxes” for domestic gas users, encouraging energy users to favour gas heating over electric heating. If the same level of carbon taxes were applied then gas would rise by 0.69 pence per kWh.

There is talk that carbon taxes will have to rise to £100 per tonne CO2e by 2035, for the UK to achieve its carbon emission targets. Assuming that:

- Emissions from electricity generation do fall from around 233 grams of CO2e per kWh in 2018 to 41 grams in 2035

- Carbon taxes are “fairly applied” to all energy sources

then carbon taxes for electricity would fall to 0.41 pence per kWh and for gas would rise by 2.1 pence per kWh.

As Table 1 below shows in round terms, this would result in gas rising from 4p to 6.1p per kWh whilst electricity would remain at around 18p per kWh. This ignores the effect of inflation or other factors, which are assumed to be the same for both gas and electricity.

| Energy carrier | 2019 Cost per kWh | 2035 Cost per kWh | 2019 Carbon taxes per kWh | 2035 Carbon taxes per kWh | |

| Electricity | 18 pence | 18 pence | 0.76 pence | 0.41 pence | |

| Gas | 4 pence | 6.1 pence | 0.00 pence | 2.10 pence |

Notes

- Currie & Brown (2019). The costs and benefits of tighter standards for new buildings. Available at https://www.theccc.org.uk/wp-content/uploads/2019/07/The-costs-and-benefits-of-tighter-standards-for-new-buildings-Currie-Brown-and-AECOM.pdf [Last accessed 5 November 2019]

Leave a Reply