The idea of using solar panels to generate electricity to power your home is an appealing one for many of us. Helping to save the planet from climate change whilst also reducing sometimes eye-watering energy bills must be good, right? And whilst we’re about it, why not add some battery storage to avoid having to export electricity to the grid?

Will I Get a Payback on an Investment in Solar Panels & Battery Storage?

Simple answer; not at the moment. Whilst saving the planet is certainly worthwhile, at today’s prices the payback on most solar PV installations is likely to be over 20 years. Adding storage batteries considerably worsens the payback. Unless you enjoy being a market pioneer, Great Home would recommend delaying a solar PV or battery storage investment until system prices fall further and the market price for solar exports to the grid becomes clearer.

The typical investment costs and benefits of installing a 4kW Peak solar system and 13.2 kWh of battery storage are summarised in Figure 1. The solar system alone delivers a 21.3 year payback. Adding battery storage to an existing solar system delivers a 52 year payback, much longer than the warranty available on the storage batteries. Combining the two investments gives a payback of 30.5 years, again much longer than the warranties on the systems.

To get payback on solar panels under 10 years then installed prices would have to more than halve to around £3,400. For solar batteries, a 10 year payback would need an installed cost for 13.2 kWh of around £1,442. You can calculate your own figures based on different assumptions by using the Great Home Solar Panel & Battery Storage Calculator.

Figure 1: Payback on 4 kW peak solar panels and 13.2 kWh battery storage

| Installed Cost | Annual Benefit | Payback (years) | |

|---|---|---|---|

| Solar system alone | £7,264 | £340.60 | 21.3 |

| Additional battery storage investment* | £7,500 | £144.23 | 52.0 |

| Combined investment | £14,764 | £484.83 | 30.5 |

* additional costs/benefits only

You can see detailed assumptions and explanations below.

Detailed Breakdown Of Payback for Typical System

The typical home uses around 3,500 kWh of electricity per year (9.6 kWh per day). Investing in a 4 kW peak rooftop solar PV system would typically cost £7,264 and generate 3,400 kWh of electricity per year (9.3 kWh per day) which is close to matching home energy use.

Figure 2 shows that the annual benefits are likely to be £340.60 based on electricity prices of 18p per kWh and an assumed Smart Export Guarantee payment of 5.38p per kWh (the same as the FIT rate for systems installed prior to April 2019). This would deliver a payback on the investment in 21.3 years.

Figure 2: Annual benefits of typical 4 kW Peak solar PV system

| kWh produced | Payment / benefit per kWh | Annual benefit | |

|---|---|---|---|

| Solar exported: | 2,151 | 5.38p | £115.70 |

| Solar, own use bill savings: | 1,249 | 18p | £224.90 |

| Total annual benefit: | 3,400 | 10p | £340.60 |

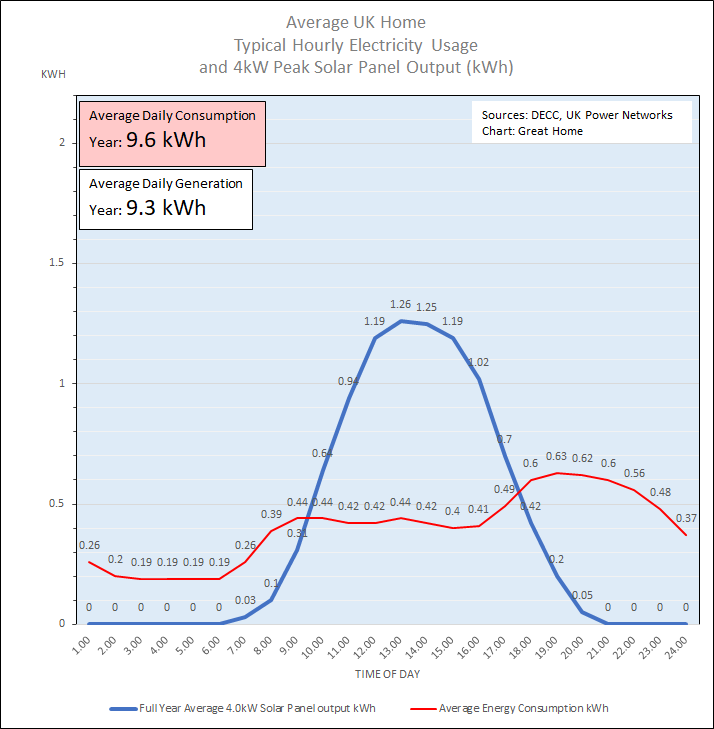

It depends on a home’s electricity usage profile but around 63% of the electricity generated by the solar panels will be exported to the grid, with only 37% being used to power the home. Figure 3 below illustrates the challenge, with the red line showing home energy consumption and the blue line solar electricity generation. Peak time for solar generation is the middle of the day whilst home electricity demand peaks during the early evening. For those out working during the week the profile would be even more extreme. There are ways of switching some electricity demand, such as running dishwashers and washing machines on timers during the day, but these opportunities are limited.

The obvious question is what would happen if battery storage was added to the system.

Figure 3: Typical Electricity Usage and Solar Generation

4kW Peak Solar PV System with 13.2kWh Battery Storage

Adding battery storage will increase the amount of solar-generated electricity used by the home, but does not deliver sufficient financial benefits to give a payback. Figure 4 shows that exports drop to 1,007 kWh (from 2,151 kWh without battery storage) and that a further 1,143 kWh of solar generated electricity is stored in the battery for later use in the home. Annual benefits would be £484.83 which is an improvement of £144.23 on the solar system alone of £340.60. To obtain the additional £144.23 annual benefit, an investment of circa £7,500 would have to be made in the battery storage system; a payback of 52 years on a battery storage system which may last 10 to 20 years.

Figure 4: Annual benefits of typical 4 kW Peak solar PV system with 13.2kWh Battery Storage

| kWh | Payment / benefit per kWh | Annual benefit | |

|---|---|---|---|

| Solar exported | 1,008 | 5.38p | £54.21 |

| Solar used directly in home | 1,249 | 18p | £224.90 |

| Solar used in home via battery | 1,136 | 18p | £204.54 |

| Additional electricity held in battery | 7 | 18p | £1.18 |

| Total annual benefit | 2,151 | 10p | £484.83 |

As someone with almost zero knowledge of domestic solar and battery tech and economics, I’d love to see an updated version of this page. Writing in 2022, with the current energy crisis and Russian invasion of Ukraine. I assume solar and battery payback would be much more favourable.

I presume the calculations done on this previously assume no change in energy pricing over the lifespan of the panels and battery, which seems unlikely. (Not a criticism, this seems to be the same typical with various online calculators I’ve looked at, understandably giving the inherent difficulties in make such predictions).

We’ve never previously had the funds to allow us to seriously consider a solar installation, but now we do, the one thing I do wonder about is the aged slate roof on our Victorian property. Would it be daft to consider a solar installation without first re-roofing our property?

Hi Jon, I am very pleased to have found your article that looks into the cost, benefit and payback periods of solar PV, integrated battery storage, and battery storage alone. I invested in a 4 kWp system in 2012 when the FIT was 21 p/kWhr and 3 p/kWhr for exporting power to the grid (they assume 50% self-consumption). It cost £8k and I worked out that with the subsidy I’d get my money back in ~ 8 years, which I did. It looks to me from your article that getting rid of the FIT is resulting in such large payback periods that people who work out the economics of an investment won’t go ahead now. Has that happened, or do you think that most people don’t see solar PV in economic terms, they invest to save the planet?

Similarly, the energy storage industry is aggressively market their systems, but I did my own analysis and came to similar conclusions to yours, that as an investment they are terrible. I do worry that more gullible people will be missold battery storage systems, I wonder what your thoughts are on this?

I lecture renewable electrical power at Cambridge University so I am very interested, as are the students, in these technologies, indeed bulk energy storage is a big enabling technology to integrate more renewables. But surely they need government subsidy to take off?

Hi Tim,

Thanks for the feedback. The early years of solar did provide very attractive financial returns, which helped build a worthwhile base of domestic solar in the UK. I think it was inevitable that the FIT scheme was eventually curtailed and stopped although the execution of this policy could have been done far more effectively to avoid booms and bust in the installation industry. Nowadays solar should stand on its own as prices fall. Although the payback is not exciting that could be said for many investments in a low interest rate economy.

On batteries, part of the reason I produced the Great Home battery storage calculator (https://great-home.co.uk/solar-export-guarantee-seg-calculator/) was to try and counter some of the dubious sales claims on battery storage. There is still a great deal of smoke and mirrors whilst the actual position is much more nuanced. I think that as battery prices fall and 30-minute pricing becomes more widespread then it will become an unexciting but reasonable investment for the average person connected to the grid. The government could probably help most by removing the 20% VAT on battery storage products as well as ensuring future 30-minute pricing was fair to the consumer. There is also a danger that the battery storage manufacturers aim their software at benefitting themselves and/or the electricity industry rather than the consumer. For me the consumer with a battery should be able to take the benefit of frequency response payments themselves, without involving other parties. The next few years should be interesting as battery storage becomes mainstream!

Al the best with your lecturing

Kind regards

Jon